SEQUENCE OF RETURNS

Don't let this wipe you out!

If you have been investing for retirement, this may be the most important financial planning information you have ever found.

Your understanding this principle (in the box below) may determine whether or not your family runs out of money.

|

Math101 question: What is the average of the following numbers?

Solution:

+8.3 +29.1 +31.2 -5.7 +5.6 -38.8 +6.4 +14.1 -4.0 + 22.5

The sum of all the numbers = +68.7

Divide +68.7 by the number of items (10).

No matter how the order, or sequence, of the above numbers is changed, their average is always 6.9 (rounded to the nearest 0.1).

Suppose that the above numbers represent annual percentage returns within a savings or investments portfolio during a 10-year period. The order in which those returns occur is known as "the sequence of returns". Although the average remains the same regardless how you jumble the numbers, it is the order, or sequence, in which these returns occur that largely determines how long your retirement money is going to last you and your family.

The values of separate portfolios all starting at the same size and all averaging exactly the same average return throughout a span of years, can vary substantially depending upon precisely when one happens to retire.

To repeat: When approaching retirement, or in retirement and drawing income, it is the sequence of returns that largely determines how long your money is going to last you and your family. You may wonder why this critically important principle is generally not more fully explained by multi-billion dollar banks, financial service corporations, and their representatives.

The measurement of repeated ups and downs of finanical markets is known as "volatility". Sometimes it takes years for a portfolio to regain losses experienced during a normal cyclical drop-down. This fact, in combination with the sequence of returns principle, demands that older investors move into low-risk and low-volatility investments.

When income begins to be taken from an accumulated portfolio, an understanding of the sequence of returns principle is even more critical. Retirees who are taking an income stream from their portfolio and who experience negative returns early in retirement, regardless of average annual yields, run out of money.

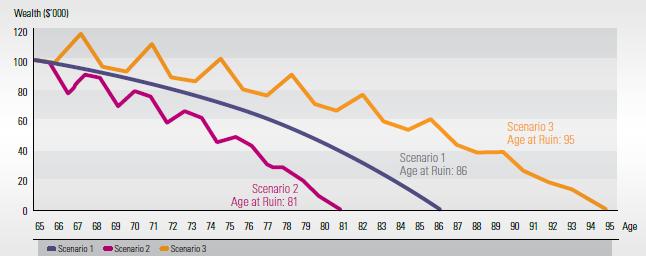

Below is a graph illustrating the impact of the sequence of returns. It assumes a $100,000 portfolio with an annual withdrawal of $9,000 for a 65-year-old. There are three scenarios. The average return in all three portfolios is 7% but the sequence of annual returns varies. This $100K portfolio illustration was made years ago. The principle is obvious. The results can be multiplied. Scarry stuff.

Source: Asset Allocation and the Transition to Income, Milevsky & Salisbury, September 2006

Only a single negative year with the relatively small early 13% drop causes money to run out years sooner. What do you think a 20% or 30% drop would have done? How will the next market "adjustment" affect retirees and pre-retirees? Years of savings and planning become compromised..

The most important fact for seniors to understand: Sequence of Returns is their number one investment enemy. A strategy is needed to avoid losses in one's portfolio, regardless of subsequent gains.

If you have questions or are dissatisfied after dealing with banks, corporate wire-houses, stockbrokers, and other company salesmen feel free to contact me. You do not need to be wealthy to chat with me. Telephone to speak with me or leave me a message. If I don't reply please try again. I will probably get back to you shortly.

For another example of this principle, click here.

Astute investors are aware of corporate interests and of the commissions interest of salespersons. In addition, they are aware of market volatility, cycles of exuberant growth in their investments followed by market "corrections" (drops) every 5-7 years, on average. Advised to "buy and hold", they think that because market values eventually exceeded previous gains and because they saw markets crash but recover repeatedly, they make the dangerous mistake of viewing volatility as simply a minor inconvenience.

As one's portfolio grows over a number of years, losses may be offset by gains. When investors enter their retirement zone, the sequence of returns issue becomes critical because time is no longer on their side.

As markets and individual stock prices go up and down, salesmen generally continue to "work with" retired clients to generate their commissions. Volatile returns experienced as one nears and enters retirement can have huge impacts on one's accumulated wealth although the resulting damage is often not immediately recognized.

The probability of having even just one severely negative year early in retirement is totally unacceptable. Its results can be personally devastating.

Commissioned salespersons of huge financial service organizations, banks and broker-dealers, when faced with losing informed clients who grasp the sequence of returns issue, propose solutions such as cash set-asides, "laddering" of bonds having different maturities, and the widely practiced "solution" of shifting from stocks to bonds. An online search reveals a number of other ways proposed to, hopefully, cope with this formidable problem. Some of these, including a complicated options strategy (costless collars) can be confusing and burdensome, particularly for older heads. Various strategies are touted, unsurprisingly, with a view to keeping clients and preserving corporate incomes.

In order to prevent potential unrecoverable losses, investors who are approaching retirement or in retirement need an advisor who employes a strategy that has in the past proved to be effective in minimizing portfolio volatility and decreasing risk while producing competitive returns.

Combined with the necessity of minimizing risk posed by the Sequence of Returns Principle, it has been pointed out in many places that low volatility investing works per se. A widespread understanding of this would probably decimate incomes of many commissioned salesmen. That may be one of the reasons, along with this "sequence" illustration, brokerage salesmen sometimes forget to discuss either.

Stewart Ogilby

mobile: (941) 545-3600

toll-free: (800) 998-2523 -- (not from area code 941)

The information provided on this website is for informational purposes only and does not constitute investment advice or any offer or sale of any investment product.

Copyright 2025: Wisebird Financial, LLC

8470 Enterprise Circle, Lakewood Ranch, FL 34202.