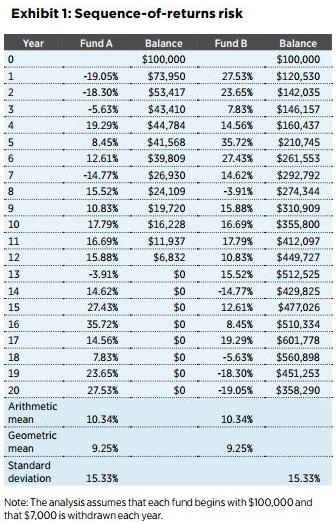

"To fully appreciate the value of reducing downside risk in retirement accounts, we should first understand the most significant investment risk that a retiree faces: 'sequence-of-returns risk.' Sequence-of-returns risk relates to the timing or sequence of a series of adverse intestment returns.

"Exhibit 1 provides a clear and dramatic illustration of this risk. In this example, two funds, A and B, each begin with $100,000. From each, $7,000 is withdrawn per year. Each fund experiences exactly the same returns over a 20-year period - only in inverse order - or 'sequence.'

"Thus, the average return and volatility of each fund is the same but the timing of returns is different."

- W. Van Harlow, Ph.D., CFA, Director of Research, Putnam Institute.